Post Activity

36

36

Table of Content

Share This Post

Table of Content

Russia’s IT outsourcing market, valued at $26.80 billion in 2024, offers a compelling blend of cost efficiency, a robust talent pool, and advanced digital infrastructure. Yet, geopolitical instability and data privacy concerns require careful navigation.

This article provides a comprehensive, data-backed analysis of Russia’s IT outsourcing landscape, equipping strategic decision-makers with insights to evaluate its potential for software development, AI development, cloud solutions, and more.

Strategic Recap Navigating IT Outsourcing in Russia

i. Benefits:

- Access to highly skilled software developers, data engineers, and AI specialists.

- Competitive labor costs, often 20–40% lower than Western Europe.

- Time zone alignment with European Union markets for smoother collaboration.

- Moderate English proficiency and strong communication skills for effective management.

- Advanced digital infrastructure with strengths in cybersecurity and AI.

- Cultural alignment with structured project management practices.

- Strong innovation ecosystem driven by R&D centers and startups.

- Government-backed IT reskilling programs that enhance workforce quality.

- Geographic proximity enabling efficient nearshore outsourcing to EU markets.

ii. Challenges:

- Geopolitical instability and sanctions create risks for project continuity and supply chains.

- Data protection laws lack an EU adequacy status, complicating cross-border data transfers.

- Unvetted outsourcing vendors in the past have caused ROI visibility and quality assurance issues.

Thinking About Outsourcing?

Discover a curated list of trusted software development firms based in Russia. Find the right team for your next project.

Country Overview

Russia spans 11 time zones (UTC+2 to UTC+12), enabling flexible nearshore collaboration with Western Europe and partial alignment with North America. Its business environment supports a tech sector contributing 3.5% to GDP, with an inflation rate of 9.3% and a foreign exchange rate of approximately 78.44 RUB to USD.

The digital public infrastructure, bolstered since the 2000s, emphasizes cybersecurity, AI capabilities, and sovereign internet control, reflecting a national digital strategy focused on technological sovereignty.

With a Human Capital Index of 0.7 and moderate English proficiency per the EF Index, Russia’s tech education system produces 520,000 STEM graduates annually. Public private initiatives, including a $577 million venture fund, support home grown tech companies and R&D centers.

However, the legal environment lacks an EU data adequacy status, and data protection laws enforced by Roskomnadzor face scrutiny for inconsistent application, complicating compliance for European Union clients.

Russia’s Strategic Positioning

- Geographic Advantage: Multiple time zones enable tailored collaboration with global markets.

- Economic Context: Competitive labor costs due to a lower cost of living compared to Western Europe.

- Government Support: Investments in tech education and AI development aim to add 700,000 developers by 2030.

- Challenges: Geopolitical instability (Political Stability Index: 17.06) and lack of EU data adequacy require robust risk management.

Bloom of the IT Industry: A Historical Perspective

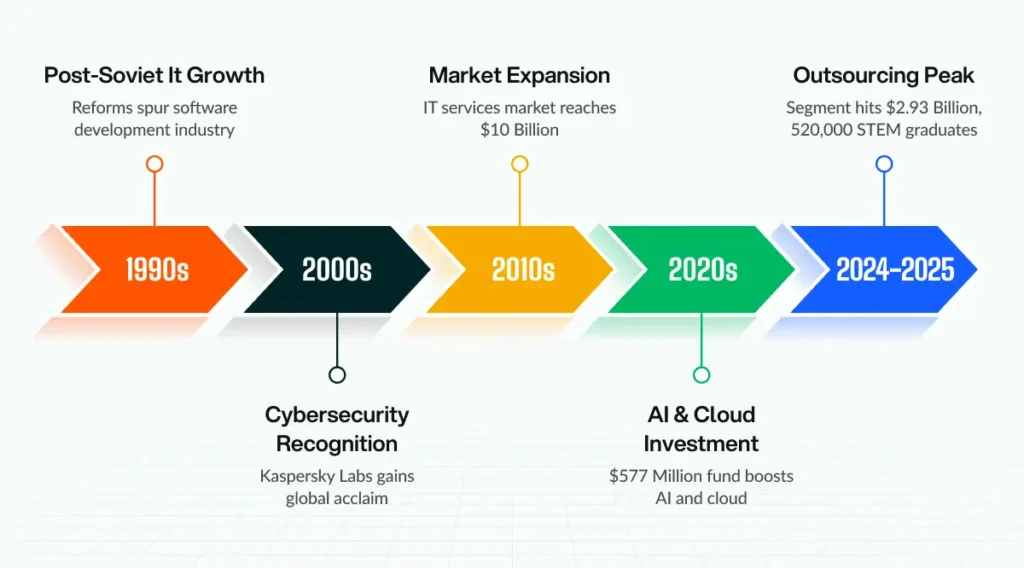

Russia’s IT industry has evolved significantly since the early 1990s, transitioning from a nascent sector to a global contender in IT outsourcing. Post-Soviet economic reforms sparked growth, with the tech sector emerging as a driver of diversification. By the 2000s, Russia’s focus on technical education produced a steady stream of STEM graduates, laying the foundation for a robust talent pool. Early players like Kaspersky Labs established Russia’s reputation in cybersecurity, while government initiatives fostered R&D centers in Moscow and St. Petersburg.

The 2010s marked a pivotal decade, with IT services growing due to increased global demand for software development and BPO industry services like call center services. By 2015, the IT services market reached $10 billion, driven by software engineers skilled in programming languages like C++ and Java. Investments in digital infrastructure, including cloud computing and data analytics, accelerated growth, supported by a $577 million venture fund launched in the 2020s to bolster home-grown tech companies. Today, the market is valued at $26.80 billion (2024), projected to reach $63.46 billion by 2033 with a 9.3% CAGR.

The IT outsourcing segment, expected to generate $2.93 billion in 2025, thrives on an 8.10% talent pool growth rate and 520,000 annual STEM graduates. Russia’s startup ecosystem, ranked 34th globally, includes 1,970 startups with over $163.05 million in funding, focusing on artificial intelligence, cloud solutions, and data engineering. The Inclusion in Global AI Index (0.56) reflects Russia’s push for AI driven personalization. Government programs doubling IT related university budgets aim to add 700,000 developers by 2030, cementing Russia’s role in the global technology markets.

Outsourcing Operations and Models

Russian outsourcing firms excel in offshore development, nearshore outsourcing, and hybrid models, delivering custom software, mobile app development, software quality assurance, and cloud computing services. Dedicated teams of software engineers, team leads, and project managers leverage agile workflows to meet technical requirements and ensure quality standards.

The BPO industry, including call center services and customer support, complements IT services. Firms often use hybrid models to balance control and flexibility, addressing IP protection under the Copyright Act. Agile software development and DevOps services enable rapid scaling, while real time collaboration tools ensure project management efficiency.

Common Outsourcing Models

- Dedicated Development Teams: Ideal for long term projects like digital transformation or AI powered app development.

- Project Based Outsourcing: Suited for minimum viable products (MVPs) or specific software solutions.

- Managed Services: Covers cloud infrastructure, data analytics, and customer service for operational efficiency.

- Staff Augmentation: Addresses talent shortages by integrating Russian tech professionals into in house teams.

Ready to Build Your Team?

Let’s create together, innovate together, and achieve excellence together. Your vision, our team – the perfect match awaits.

Scaling Success with Tech Talent

Russia’s tech talent drives success for global firms. For example, multinational companies establish development centers in Moscow, leveraging software engineers for cybersecurity and cloud solutions. Kaspersky Labs exemplifies Russia’s ability to deliver high quality software outsourcing, exporting security products globally.

Another case involves a fintech firm outsourcing AI driven personalization and data engineering to a St. Petersburg-based team, reducing costs by 30% while meeting quality standards. These successes highlight Russia’s capacity to handle complex projects, from mobile app development to database systems, enhancing user experience and customer base growth.

Success Factors

- Technical Expertise: Proficiency in programming languages like Python, Java, and C++.

- Scalability: Access to 520,000 STEM graduates annually supports rapid team expansion.

- Cost Efficiency: Lower software development rates compared to Western Europe.

- Innovation: Leadership in AI development and cloud computing for cutting-edge solutions.

Strategic Advantages of Choosing Russia

Russia offers compelling advantages for IT outsourcing, making it a viable option among the best countries to outsource software development.

- Its talent pool, supported by a robust tech education system, provides access to software developers, data engineers, and AI specialists at competitive labor costs.

- The lower cost of living enables cost-effective software development rates, often 20–40% below Western Europe.

- Time zone compatibility with European Union markets supports nearshore collaboration, while moderate English proficiency and strong communication skills ensure effective project management.

- Russia’s digital infrastructure, with a focus on cybersecurity and AI capabilities, aligns with modern technical requirements.

Additional Strategic Benefits

- Cultural Compatibility: High uncertainty avoidance (Hofstede UAI: 88) aligns with structured project management needs.

- Innovation Ecosystem: R&D centers and startup ecosystems drive advancements in cloud solutions and data analytics.

- Government Support: Initiatives like IT reskilling programs enhance tech professionals’ capabilities.

- Market Access: Proximity to European Union markets facilitates nearshore outsourcing.

Limiting Factors When Working with Russia

Businesses considering IT outsourcing in Russia today face significant challenges:

- Geopolitical instability, with a Political Stability Index of 17.06, poses significant risks, including sanctions, trade disruptions, and cyber threats stemming from Russia Ukraine tensions. These factors can impact project engineering and supply chain reliability.

- Data protection laws, while advancing toward GDPR standards, lack EU data adequacy status, complicating data transfers for European Union firms. Enforcement inconsistencies and sovereign internet controls raise concerns about data privacy.

- Past experiences with unvetted outsourcing firms underscore the need for rigorous vendor selection to ensure ROI visibility and software quality assurance.

Decision Matrix for Risk Mitigation

The following table summarizes mitigation strategies for each risk, helping decision-makers prioritize actions based on impact and feasibility.

Emerging Outsourcing Trends Influencing Russia’s IT Sector

The IT outsourcing industry is evolving quickly as businesses prioritize cost efficiency, specialized talent, and scalability. In 2025, offshore and nearshore models dominate, with Eastern Europe emerging as a hub for software engineers, project managers, and data experts. Agile development, DevOps, and real-time collaboration tools drive efficiency and quality.

Russia aligns with these trends, offering skilled professionals in programming, databases, mobile apps, and AI-powered solutions. However, geopolitical risks, legal barriers, and time zone gaps require careful evaluation. Decision makers must weigh Russia’s cost advantages against concerns around IP protection, data privacy, and cultural fit to secure long-term ROI.

Key Outsourcing Trends Impacting Russia

- Demand for expertise in AI, cloud, and data engineering.

- Preference for nearshore models to enable time zone alignment.

- Growing focus on agile workflows and DevOps for faster delivery.

- Increased emphasis on data protection, cybersecurity, and vendor transparency.

Vendor Selection Checklist

Select vendors with:

- Industry specific expertise (e.g., healthcare, fintech);

- Proven global delivery and international track records;

- Agile processes and robust IP security protocols;

- Scalability to handle growing project demands over time;

- Adequate team size to ensure resource depth;

- Positive client feedback and case studies demonstrating impact;

- Multi-time-zone support for seamless distributed team coordination;

- Transparent pricing models with clear cost breakdowns.

Final Thoughts

Russia’s IT outsourcing landscape offers a strategic opportunity for decision makers seeking innovative solutions in Eastern Europe. Its talent pool excels in software development, AI development, and cloud solutions, supported by a robust digital infrastructure.

Russia’s tech professionals and innovation ecosystem position it as a contender among the best countries to outsource software development, provided you navigate its challenges strategically. Russia can accelerate your digital transformation with the right partner, provided you carefully evaluate your options

Find Your Perfect Software Outsourcing Partner

Unlock a world of trusted software outsourcing companies and elevate your business operations seamlessly.