Post Activity

147

147

Table of Content

Share This Post

Table of Content

China’s IT outsourcing industry is a juggernaut, with an IT services market valued at USD 448.2 billion in 2025, growing at a steady pace thanks to government-backed initiatives like Digital China and Made in China 2025.

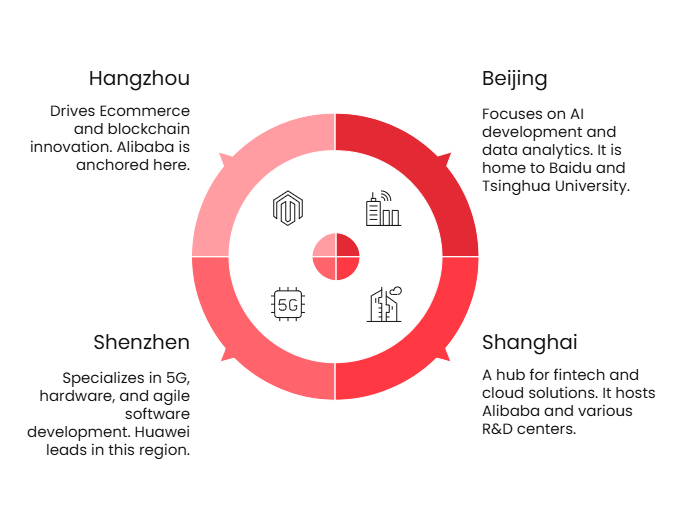

Home to global tech hubs in Beijing, Shanghai, Shenzhen, and Hangzhou, China excels in software development, AI development, cloud computing, and agile software development. For strategic decision makers seeking cost optimization and access to a vast talent pool, this guide unpacks China’s role as a leader in IT outsourcing and digital transformation.

Strategic Overview: Why China Leads in IT Outsourcing

i. Benefits

- Offers significantly lower software development costs.

- Provides favorable time zone alignment for global collaboration.

- Delivers strong technical expertise across modern technologies.

- Maintains workable English communication in major tech hubs.

- Adopts agile workflows that align with Western business practices.

- Demonstrates success across key industries like fintech and healthcare.

ii. Challenges

- Faces geopolitical risks that may affect long-term planning.

- Presents concerns around consistent intellectual property protection.

- Experiences currency fluctuations that can affect cost stability.

- Encounters communication gaps outside major urban centers.

- Shows cultural differences that may impact agile collaboration.

- Has limited talent availability in emerging tech specializations.

China’s Tech Ecosystem: A Powerhouse for Innovation

China’s tech landscape is unmatched, with global tech hubs in Beijing (AI and data engineering), Shanghai (fintech and cloud infrastructure), Shenzhen (5G and hardware), and Hangzhou (e-commerce and blockchain). Ranking 13th in the Startup Ecosystem Health Index, China hosts 47,000+ startups and giants like Alibaba, Tencent, and Huawei. With a Digital Infrastructure Index of 0.19 and 90% internet penetration, China’s digital public infrastructure—bolstered by 5G and 300 EFLOP/s computing power—enables scalable software solutions and real-time collaboration.

The economy of China at a glance

| Gross Domestic Product | ||

| Annual GDP | USD 17.8 Trillion (2023) | |

| GDP Per Capita | USD 12,614 (2023) | |

| Income Category | Upper-middle Income (2025) | |

| People | ||

| Population | 1.4 Billion (2025) | |

| Literacy Rate | 97% (2020) | |

| EF English Proficiency Index | Low Proficiency (2024) | |

| IT Sector | ||

| IT Services Market Size | USD 84.2 Billion (2025) | |

| IT Outsourcing Market Size | USD 32.1 Billion (2025) | |

| Registered Software Companies | 35,000+ | |

| Business Environment | ||

| Ease of Doing Business | Score: 78/100 (2020) | |

| Political Stability Indicator | Percentile Rank: 25 (2023) | |

| Corruption Perceptions Index | Score: 42/100 (2023) | |

The tech education system, led by Tsinghua, Peking, and Zhejiang universities, produces 5 million STEM graduates annually, fueling a talent pool of software developers and IT professionals.

Public private tech programs under the National Data Administration’s 2025 plan drive reskilling initiatives, ensuring a growing tech talent pool. A Human Capital Index of 0.7 and a Global AI Index of 0.64 underscore China’s leadership in artificial intelligence and software engineering.

Historical Context: China’s IT Outsourcing Evolution

2000s: Laying the Foundation

China’s IT outsourcing began with BPO industry services in finance and customer support. Tech parks in Shenzhen and Shanghai, supported by early legal frameworks, attracted foreign investment. The tech education system scaled STEM graduates, building a foundation for software outsourcing.

2010s: Global Competitor

The Made in China 2025 strategy prioritized AI development, cloud computing, and smart manufacturing. Firms like Neusoft and Pactera delivered cloud solutions and data analytics, competing with Eastern Europe and Latin America in software development and project management.

Explore Your Next Development Partner

Browse leading Chinese development companies that deliver global-quality solutions.

2020–2025: Innovation Leader

China’s IT services market surged to USD 448.2 billion, driven by USD 3.5 billion in digital innovation grants and the National AI Strategy. The PIPL strengthened data privacy, while R&D centers and public-private tech programs enhanced software quality assurance and DevOps services. China’s IT exports grew, cementing its role in technology markets.

Strategic Advantages of Outsourcing to China

Cost Efficiency Meets Scale: Competitive labor costs and government subsidies keep outsourcing costs low, with software development rates far below Western Europe.

Time Zone Productivity: CST (UTC+8) enables 24/7 workflows, ideal for agile software development and nearshore collaboration with Asia Pacific clients.

Advanced Technical Capabilities: Software engineers excel in database systems, AI powered app development, cloud infrastructure, and data engineering, with firms like Baidu leading artificial intelligence innovation.

Cultural Alignment: Outsourcing firms in tech hubs adopt Western agile workflows, ensuring cultural compatibility and user experience focused solutions.

Industry Fit: Expertise in fintech, healthcare, and e-commerce aligns with quality standards and customer service needs, supported by project managers and team leads.

Potential Difficulties and Solutions

- Geopolitical Risks: US-China tensions and a Political Stability Index of 25.12 pose challenges.

Solution: Partner with vendors with global footprints to mitigate disruptions. - IP and Data Privacy Concerns: PIPL compliance is robust, but intellectual property enforcement varies.

Solution: Use legal frameworks and Copyright Act expertise to secure assets. - Currency Fluctuations: A 7.15 CNY/USD rate requires careful budgeting.

Solution: Lock in USD/EUR contracts for stability. - Niche Talent Gaps: Talent shortage in areas like AI driven personalization persists.

Solution: Tap into reskilling initiatives and university partnerships. - Communication Challenges: English proficiency is lower outside major hubs.

Solution: Prioritize vendors with proven communication skills in Beijing or Shanghai.

China’s Thriving Tech Hubs

Image: China’s Thriving Tech Hubs

China’s digital infrastructure, with 5G and 300 EFLOP/s computing power, supports cloud computing and software solutions. Public private tech programs and reskilling initiatives ensure a steady supply of tech professionals.

Case Studies: Real-World Impact

Global Fintech Cloud Migration: A US fintech partnered with a Shanghai vendor to migrate to Alibaba Cloud, slashing costs by 40% and boosting uptime to 99.98%.

European AI Healthcare Platform: A Beijing firm built an AI diagnostics tool for a European hospital, improving accuracy by 35% using Baidu’s PaddlePaddle.

APAC E-commerce DevOps: A Shenzhen vendor optimized JD.com’s DevOps services, cutting deployment time by 50% and achieving 99.99% reliability.

Smart Manufacturing IoT: A Hangzhou provider developed an IoT platform for a German manufacturer, enhancing efficiency by 30% with data analytics.

These cases showcase China’s ability to deliver custom software and minimum viable products with cost efficiency and technical requirements met.

Ready to Build Your Team?

Let’s create together, innovate together, and achieve excellence together. Your vision, our team – the perfect match awaits.

Outsourcing Models for Flexibility

Staff Augmentation: Scale teams with Chinese software developers for mobile app development or AI development.

Dedicated Teams: Long-term project engineering for cloud infrastructure or fintech solutions.

Project Based Delivery: Full-cycle software outsourcing with software quality assurance for custom software.

Hybrid Approaches: Blend offshore development with local oversight using Google Meet for real-time collaboration.

Leading IT Outsourcing Companies in China

These firms deliver scalable IT services across industries, meeting technical requirements and quality standards.

Vendor Selection Checklist

Select vendors with:

- Industry-specific expertise (e.g., healthcare, fintech);

- Proven global delivery and international track records;

- Agile processes and robust IP security protocols;

- Scalability to handle growing project demands over time;

- Adequate team size to ensure resource depth;

- Positive client feedback and case studies demonstrating impact;

- Multi-time-zone support for seamless distributed team coordination;

- Transparent pricing models with clear cost breakdowns.

Final Thoughts

In 2025, China cements its status as a top destination for IT software outsourcing, rivaling Eastern Europe and Latin America. With a USD 448.2 billion IT services market, 5 million STEM graduates, and a digital infrastructure supporting cloud computing and AI development, China offers cost optimization and technical prowess.

Despite challenges like geopolitical instability and intellectual property concerns, its legal environment, public private tech programs, and cultural compatibility make it a strategic choice for digital transformation. For businesses seeking software developers, project managers, or software solutions, China delivers a competitive edge in technology markets.

Find Your Perfect Software Outsourcing Partner

Unlock a world of trusted software outsourcing companies and elevate your business operations seamlessly.